Sector navigates US crackdown, achieves strong growth

By: Chu Daye and Zhang Yiyi

China’s semiconductor companies posted stellar first-half gains as the global semiconductor industry staged a strong rebound.

Despite reckless US crackdowns, Chinese semiconductor firms have made big strides in self-reliance and fared more prominently in the global semiconductor industry, Chinese analysts said on Wednesday.

Of the 68 semiconductor companies that have released their financial reports for the first half, 40 reported revenue gains of more than 50 percent, the Securities Times reported on Wednesday. According to CITIC, there are 157 A-share listed companies on China’s semiconductor industrial chain.

Companies making storage chips, contact image sensor chips and system-on-a-chip products posted impressive gains, the Securities Times report said.

The reports provided a snapshot of China’s semiconductor industry, which has benefited from a resurgence of the consumer electronics market both at home and abroad.

“Despite tough US sanctions in recent years, China’s semiconductor industry has not only survived but also thrived. We’ve seen significant growth in production capacity, especially in mature processes, with exports surging, particularly to Southeast Asian markets like Vietnam, Malaysia and Indonesia,” Ma Jihua, a veteran telecom industry observer, told the Global Times on Wednesday.

“This expansion has been a key driver in the recovery of the global consumer electronics industry – lowering costs, increasing accessibility and sparking innovation across the board,” Ma noted. “China’s contribution to this sector is undeniable.”

Wang Peng, an associate research fellow at the Beijing Academy of Social Sciences, told the Global Times on Wednesday that, driven by multiple factors including technological innovation, a rebound in market demand and policy support, the domestic semiconductor sector is expected to remain in an upward cycle through 2025.

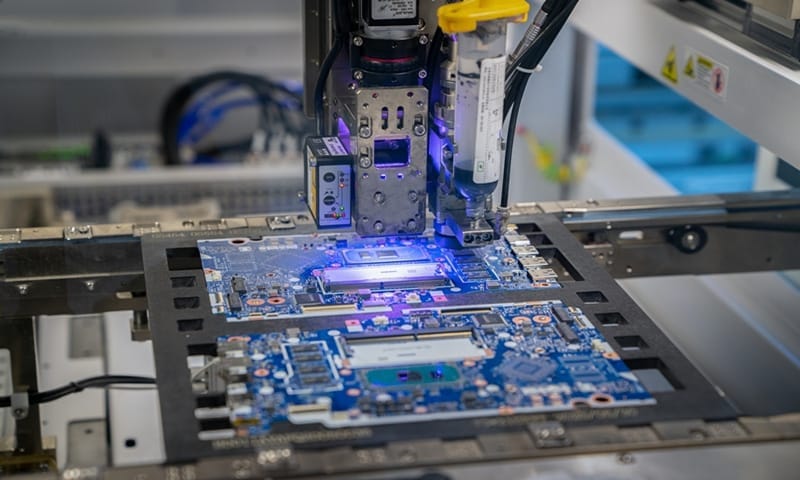

For instance, Apple’s original equipment manufacturing partner Foxconn is significantly increasing its workforce at its production base in Zhengzhou, Central China’s Henan Province as it ramps up production ahead of Apple’s new iPhone release.

In a report on Monday, domestic news outlet Caijing estimated that some 84.8 percent of Apple’s annual output of 230 million smartphones will be assembled in China, with Foxconn’s Henan facility playing an irreplaceable role.

Christophe Fouquet, CEO of Netherlands-based lithography system provider ASML, also said he believes that the world needs the “legacy chips” being produced in China, according to German business news outlet Handelsblatt.

Legacy chips are those manufactured using older, less advanced technologies. Due to the pyramid-shaped structure of global chip demand, most of the demand is still for legacy chips, according to analysts.

Ma noted that, concerned about potential US sanctions, many Chinese companies have increasingly opted for Chinese-made chips. This shift has also expanded the market and significantly boosted the growth of China’s semiconductor industry.

“China’s dominance in mature semiconductor nodes is increasing, with higher yields and lower production costs. Many American companies are becoming more dependent on Chinese products,” Ma said.

“Facing the pressure, China’s semiconductor industry has not only withstood the challenges but also has thrived, and it has strong momentum to grow faster in the future,” Ma said.

In the first seven months of 2024, China’s chip exports reached 640.91 billion yuan ($89.85 billion), up 25.8 percent year-on-year to a new record, according to official data.